Contrary to popular belief, flood insurance is not usually included with home insurance. This is a mistake that a lot of people make simply because they do not look at the fine print of their current policy or they just assume otherwise. You never want to assume this type of coverage in Pinecrest, FL because if you need it and do not have it, you could end up in a lot of financial trouble. Here at Hamilton Fox & Company Inc. these are a few different reasons you should consider getting it.

- Hurricanes happen. One of the biggest reasons to get this type of coverage is that hurricanes happen and they happen a lot in FL. You do not know when they will happen but it is good to have in place when it does.

- Your home insurance may not cover it. You will want to check with your home insurance provider but if it is not included, now is a good time to get it. Plus, it is never a good idea to assume you have it.

- Floods can happen in many situations. A flood can happen with a burst pipe, an above ground pool leaking, or even in a really bad series of storms. You should not just assume that it can only happen in hurricanes because floods happen all year long and in a lot of different and unique ways.

We think that you should always have flood insurance in place because you cannot control the weather and there are a lot of other situations that can lead to a flood as well. If you are ready to get your flood insurance, be sure to contact us today at Hamilton Fox & Company Inc. serving Pinecrest, FL. We can get you a free quote and get you set up in no time.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

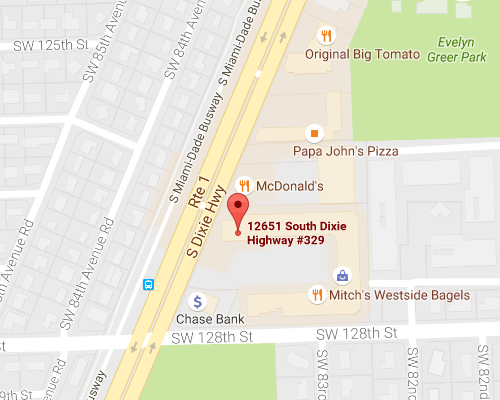

Click to Call Get Directions

Get Directions