Depending on the nature of your business, employees are likely to experience work-related injuries. In the construction or manufacturing industries, these injuries could frequently be resulting in substantial financial obligations for your business. The workers’ compensation insurance is a program that covers your employees against work-related injuries or illness arising from work-related activities. The state mandates this program, and you must speak to one of our agents at Hamilton Fox & Company Inc. in Pinecrest, FL on how your company can benefit from worker’s compensation insurance.

Benefits of workers comp insurance

- Medical expenses

The workers’ comp insurance covers your employees’ medical expenses related to a work-related injury or illness. This may include emergency room visits, surgeries, and doctor’s prescriptions. Some work injuries may be repetitive or occur over a long period of time. Exposure to some work environments may result in long term illnesses which are covered by the workers’ comp insurance.

- Missed wages

Some work-related injuries may require your employees to stay away from work until they are completely healed. This can be a substantial cost to the company to pay salaries to employees who are not working continually. The workers’ compensation insurance pays your employees wages that miss while recovering from their injuries or illnesses.

- Disability

Where workers become temporary or permanently disabled, the workers’ comp insurance provides your disabled employees with benefits that help pay their medical bills as well as replace their lost income.

- Ongoing medical cost

Injuries to the back may require constant physical therapy. This could be expensive for your organization to maintain. The workers’ comp insurance will cover such ongoing costs, including providing the right workplace equipment such as an ergonomic seat the employee may require.

- Funeral expenses

Sadly, your employee may lose life as a result of a work-related accident. This policy will cover the funeral expenses and provide death benefits to the employee’s beneficiaries.

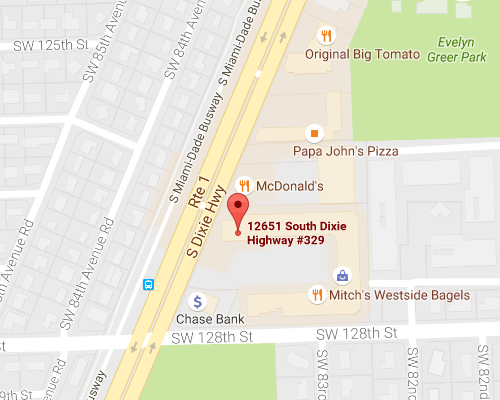

Please visit our offices or speak to one of our agents at Hamilton Fox & Company Inc. in Pinecrest, FL on the many benefits your employees will gain from worker’s comp insurance.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions