Running a business comes with a lot of responsibilities, and one of the most important is ensuring the safety and well-being of your employees. No matter how careful a workplace is, accidents can still happen. That’s why having the right workers’ compensation insurance is essential. At Hamilton Fox & Company Inc. in Pinecrest, FL, we help businesses find reliable coverage that protects both employers and employees when the unexpected occurs.

Supporting Employees in Times of Need

When an employee gets injured on the job, it can be a stressful and overwhelming experience. Medical bills, lost wages, and recovery time can quickly add up. Workers’ compensation insurance ensures that employees receive the medical care they need without the financial burden falling entirely on them. It also provides wage replacement while they recover, allowing them to focus on healing rather than worrying about missed paychecks.

Shielding Employers from Financial Strain

Workplace injuries can lead to unexpected expenses and potential legal issues for business owners. Without workers’ compensation coverage, employers could be held personally responsible for medical costs and lost wages, which can be financially devastating. A solid policy fulfills legal requirements, helps prevent costly lawsuits, and maintains a positive work environment.

Fostering a Safer Workplace for All

Investing in workers’ compensation insurance is about more than just compliance—it’s about fostering a culture of safety and care. When employees know they’re protected, they feel more secure in their roles, which leads to higher job satisfaction and productivity.

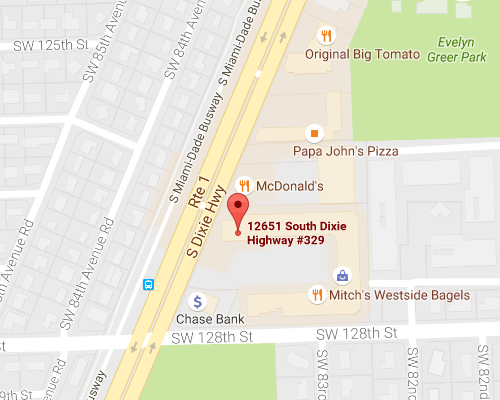

At Hamilton Fox & Company Inc. in Pinecrest, FL, we’re committed to helping businesses protect their teams and their futures. Contact us today to learn more about finding the right workers’ compensation coverage for your company.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions