No matter the size of your business, you likely want to provide some kind of security for your employees in the event they become injured or sick from conducting their job activities. It can be tricky to figure out how you should discuss these matters with people who work for you. Here are a few tips on how to do so accurately and with compassion.

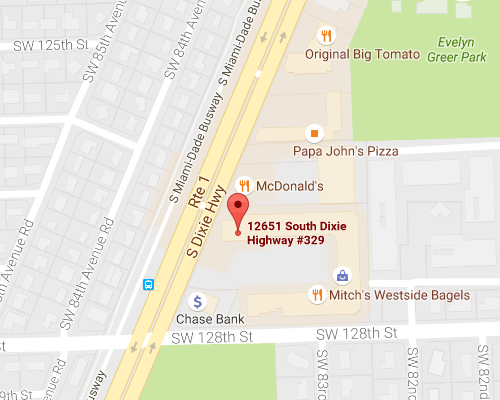

Workers’ Compensation in Pinecrest, FL

In the state of Florida, all businesses with four or more employees must offer worker’s compensation. All construction companies are required to provide this insurance to all of their employees, even if they’re contractors. Make sure to tell your employees that the laws only cover those illnesses and injuries that arise during the course of employment, though it doesn’t have to occur in the workplace. This includes when they’re running errands for the company, at a work social function, or traveling for business. If any of this is confusing and you want clarification to be able to give your employees all the facts, we can help at Hamilton Fox & Company Inc.

The Complexities for Workers’ Comp Claims

There are a variety of injuries and illnesses that are covered by workers’ compensation which includes the following:

- Occupational diseases occurring as a result of the conditions in the workplace (i.e. cancer and lung disease from being exposed to toxic chemicals)

- Cumulative trauma from repetitive stress or strain injuries from conducting the same physical tasks repeatedly

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions