At Hamilton Fox & Company, we’re always looking for ways to help our Palmetto Bay neighbors stay informed and save money, especially when it comes to vital coverage like flood insurance. We’re excited to share that beginning April 1, 2025, Palmetto Bay has qualified for a 25% premium discount on National Flood Insurance Program (NFIP) policies through the Community Rating System (CRS).

What Is the Community Rating System?

The CRS is a voluntary program under the NFIP that rewards communities for implementing floodplain management practices that exceed the program’s minimum requirements. Thanks to the efforts of the Village of Palmetto Bay to reduce flood risk through education, planning, and infrastructure improvements, the community has earned a CRS Class 5 rating—which translates to a 25% discount on flood insurance premiums for eligible properties located in high-risk flood zones (also known as Special Flood Hazard Areas).

Important: Discount Rollout is for New or Renewing Policies Effective on or after April 1st

While the effective date of the CRS Class 5 rating is April 1, 2025, discounts will not be applied midterm to your existing policy. The CRS Class 5 rating discount should be automatically applied to your newly issued or renewal policy with an effective date of April 1st 2025 or later.

Tip: Renewal offers are generally delivered 45-days in advance. If your policy renews between April 1st and May 16th you may want to double check your policy. Why? Your renewal was developed prior to April 1st and your discount may not have been applied. A manual override may be necessary to ensure the discount is properly applied to your policy.

How Will You Know You’re Getting the Discount?

If your policy qualifies, your renewal declarations will show “Community Rating Discount” and the corresponding amount should be approximately 25% of the Annual Premium as shown directly above. Don’t worry if this number doesn’t exactly equal 25% of the Annual Premium. You are still receiving the full credit if the discount is off by a few dollars.

A Word About the 25% Discount

While the CRS program offers a 25% discount, it’s important to understand that your actual savings will not be 25%. Flood insurance premiums are based on many factors, including elevation, building characteristics, and recent rating reforms under Risk Rating 2.0. The CRS credit is just one piece of the overall pricing formula and will offset otherwise scheduled rate increases.

Additionally, Palmetto Bay already qualified for a CRS Class 7 Rating Discount which applied 15% savings. The net savings difference is 10% due back to policy holders.

So, if your renewal premium doesn’t drop by the full 10%, or actually increases, don’t be alarmed—that doesn’t mean you’re not receiving the benefit. It simply means that other factors are influencing your final premium.

What Should You Do Next?

- Review your declarations page once you receive the revised version.

- Contact your insurer or our agency if you have questions about how the CRS credit is being applied.

- Stay insured—flooding is a real risk in South Florida, and this discount makes protection more affordable.

- Private flood an option? – Not satisfied with your flood insurance policy cost? Consider private flood options. Contact our quote team to access more than 10 private flood insurers.

For more information, here is a link to the notice:

https://www.palmettobay-fl.gov/DocumentCenter/View/18376/CRS-Class-Rank-5–Notice-from-FEMA?bidId=

To learn more about how to save on flood insurance in Palmetto Bay, or any Florida city, visit our flood webpage HERE.

At Hamilton Fox & Company, we’re here to guide you through this transition. Feel free to reach out if you’d like us to review your policy, explain your coverage, or answer any flood insurance questions.

Reference: Wright Flood, NFIP Underwriting Team

Stay safe, stay informed, and as always—thank you for trusting us with your insurance needs.

Your Local Team at Hamilton Fox & Company

New Quotes: 855-4A-QUOTE or 855-427-8683 or quote@hamfox.com

Existing Customers: 800-263-1947

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

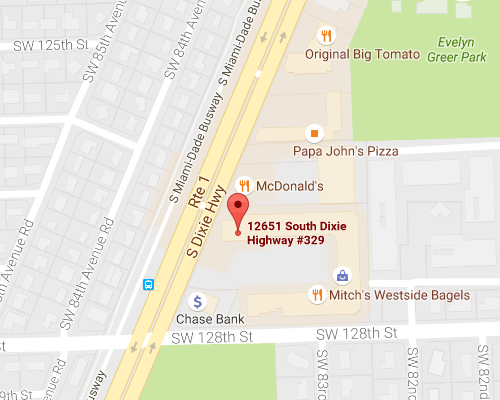

Get Directions